New Tax Increases in Ukraine: National Bank Named Conditions.

The National Bank of Ukraine does not rule out the possibility of introducing new taxes if it is necessary to cover additional needs of the state budget.

This information was provided by the Ministry of Finance, referring to the NBU report for October, which is called the Inflation Report.

The mentioned report states that the main assumptions of the macroeconomic forecast are based on the draft legislative changes. This draft provides for an increase in rates of certain taxes, particularly the military levy, the tax on profits of banks and non-bank financial institutions, as well as a review of excise rates.

"In the event of additional budget needs, the source of their coverage may be the increase of existing or the introduction of new taxes," the document states.

According to the NBU estimates, the impact of such tax initiatives on the inflation rate in the country may vary, depending on their parameters. For example, raising consumption taxes, such as VAT, has greater short-term risks regarding increasing inflation, as it will immediately affect the cost of goods and services for consumers.

In turn, direct taxes generally have a neutral effect, as the inflationary impact from the growth of government spending will be balanced by the restriction of private consumption.

Read also

- The RF attacked Chuhuiv - hospital damaged and there are casualties

- Putin Wants to Establish Digital Slavery for Foreigners

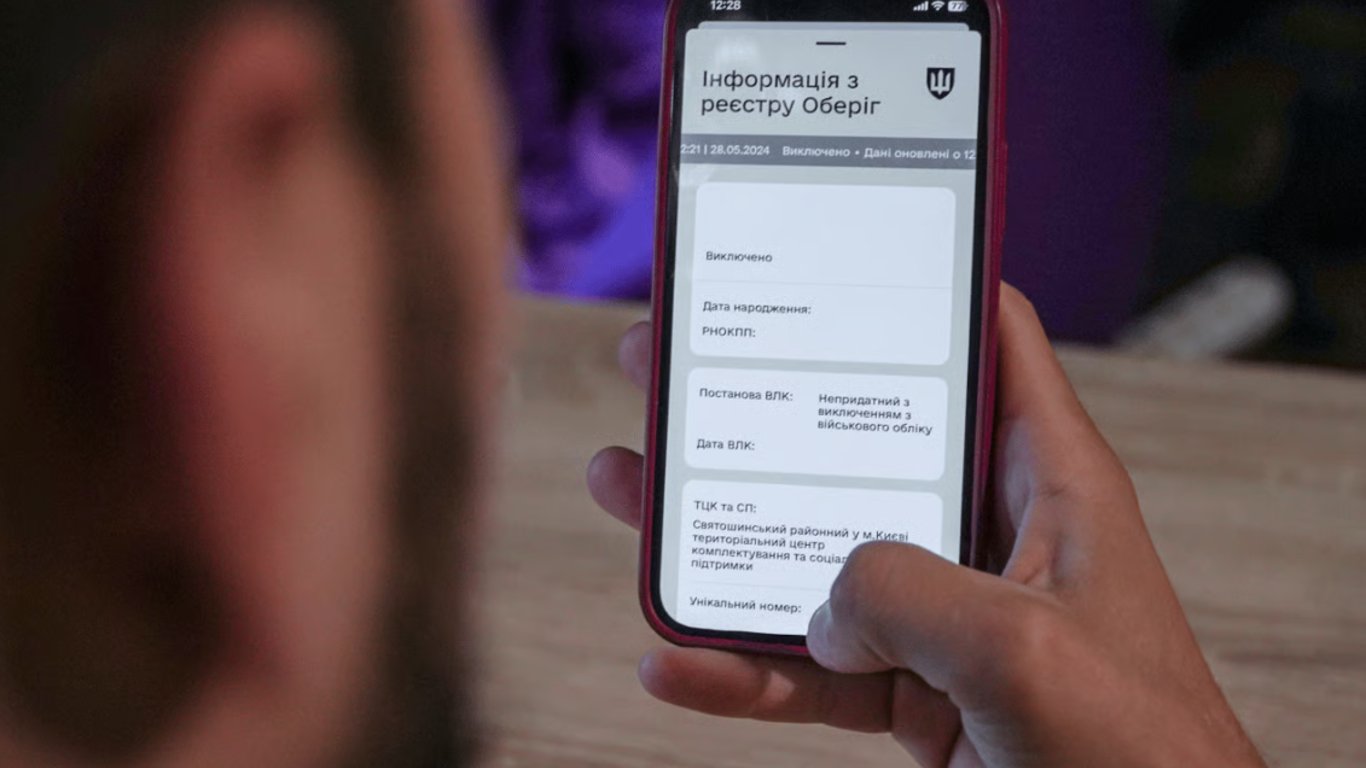

- Error in automatic military registration - what to do

- Zelensky discussed weapons and sanctions against the Russian Federation with US senators

- Father of three children did not appear at the military enlistment office — how the court punished him

- Zelensky discussed with Tusk the production of weapons and strengthening air defense